Helping 50+ founders measure & optimize PMF. Average 28% improvement in 60 days

Turn Customer Feedback into Product Market Fit

Collect Feedback

In-Product Survey Pop Ups

Trigger targeted surveys anywhere in your product to measure satisfaction and track PMF signals

- ✓PMF templates (Sean Ellis, NPS, CSAT)

- ✓Custom survey builder

- ✓Native-looking designs

Always-On Feedback Button

Catch continuous insights about what's working, what's not, and early PMF signals

- ✓Identify power users & detractors

- ✓Collect feedback 24/7

- ✓Bugs, suggestions, feature requests

No code Surveys that show based on Time, Scroll, Exit Intent

Survey Pop Ups that automatically collect feedback based on time on page, scroll depth and exit intent

- ✓Time-based (after X seconds)

- ✓Scroll depth (at X% scrolled)

- ✓Exit intent (when user leaves)

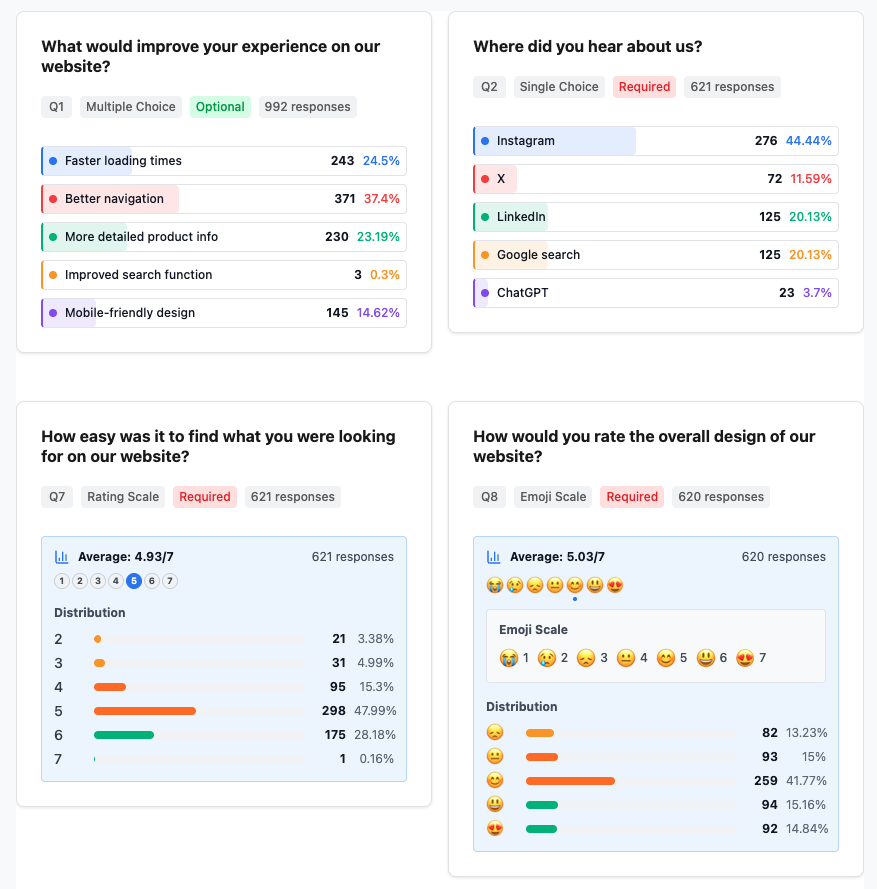

Analyze Your Feedback

Instant PMF Score Calculation

No more manual spreadsheet analysis. See your Product Market Fit score in real-time using the proven Sean Ellis 40% benchmark.

Geographic Insights: Where Does Your Product Work Best?

PMF isn't universal. Your product might crush it in one market and flop in another. See exactly where you're winning on an interactive map.

Turn Insights Into Action

Your PMF score determines your strategy

Low PMF

Crisis mode - major changes needed

🚨 URGENT ACTIONS:

- 1.Interview detractors: Understand why users aren't satisfied

- 2.Segment analysis: Find ANY group above 30%

- 3.Pivot consideration: May need to change direction

- 4.Cut burn rate: Extend runway while iterating

Getting Close

Dangerous zone - don't scale yet!

⚠️ KEY ACTIONS:

- 1.Talk to super-fans: What makes them love you?

- 2.Double down: Focus on high-PMF segments only

- 3.Fix pain points: Address top 3 complaints

- 4.Test positioning: Refine messaging for champions

Strong PMF! 🎉

Time to scale aggressively

🚀 GROWTH ACTIONS:

- 1.Increase marketing: Scale proven channels

- 2.Raise funding: Now is the right time

- 3.Expand segments: Find similar customer groups

- 4.Build for power users: Features they want

Survey Templates for Deep Insights

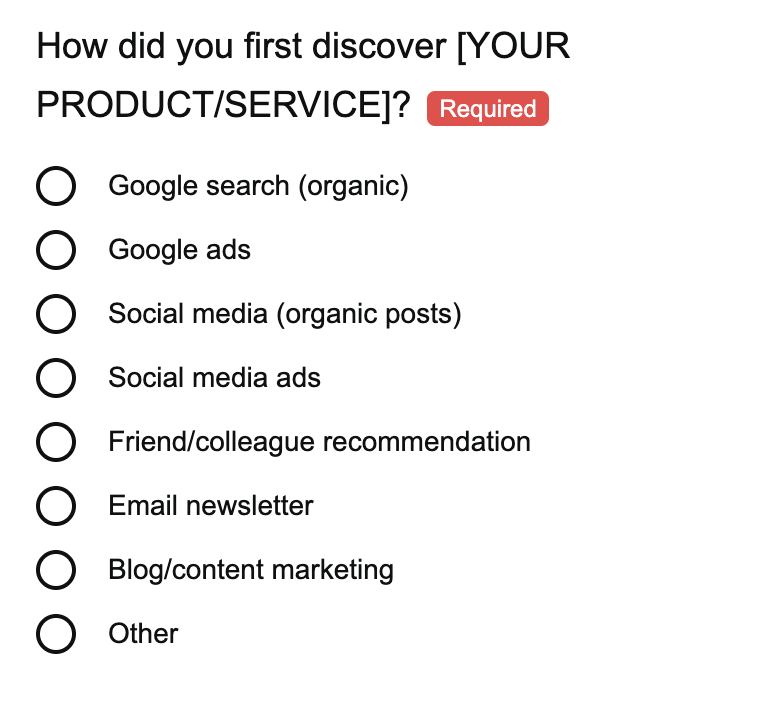

Know Where your Best Customers Come From

Track which marketing channels drive your most valuable customers and identify which channels bring users that love your product (PMF segments)

📍 Where & When to run:

After sign-up or first purchase to capture attribution while it's fresh in the customer's mind

- Identify highest performing acquisition channels

- Learn about the kind of visitors you are getting

"But wait, don't Surveys just..."

Honest answers to common objections about measuring Product Market Fit

Yes, people can be polite or give rushed answers - that's why the PMF survey asks the specific question: "How would you feel if you could no longer use this product?"

This forces users to imagine life without your product, which gets more honest responses than "Do you like our product?"

More importantly, Mapster collects the qualitative "why" alongside the score. You'll see patterns in the feedback: "I'd be very disappointed because [specific reason]" - that's the gold. The score is just a benchmark, the feedback tells you what to do next.

You're right - PMF is messier than a single score. A product can score below 40% just because onboarding sucked, or the target audience wasn't right, not because the core value prop is broken.

That's why Mapster shows you segmentation by user type, geography, pricing tier, etc. You might discover that enterprise users score 60% PMF while starter plan users score 15% - that tells you exactly where to focus.

The 40% benchmark isn't a "pass/fail" grade - it's a starting point for diagnosis. Think of it like a thermometer: 37°C is normal body temp, but the real insight comes from tracking changes over time and understanding context.

100% agree - organic retention, word-of-mouth, and users pulling you forward are the ultimate PMF signals. But here's the problem: those signals show up after you've already spent months building the wrong thing.

Surveys give you early warning signals before you waste time scaling. If you survey your first 10-15 active users and only 1 says "very disappointed," you know something's off before you spend $10k on ads.

The biggest tell for PMF is when users start complaining loudly when you change something or when a feature breaks - Mapster helps you identify those power users early so you can focus on replicating them, not guessing.

No - this is the biggest mistake founders make. They wait until they've spent months on paid ads or SEO, get hundreds of users, then realize they've been attracting the wrong audience the whole time.

Run your first PMF survey with your first 10-15 active users (people who've actually used the product, not just signed up). This early signal tells you if you're on the right track or need to pivot before scaling.

If you wait until you have 1,000 users to measure PMF, you've already made decisions based on vanity metrics (signups, page views) instead of the signal that actually matters: do people love this enough to be very disappointed without it?

This happens when founders find PMF with a tiny niche but can't replicate it at scale. Classic example: you get 50% PMF score from 20 early adopters who are your friends in the same industry, but it doesn't work for strangers.

The real insight isn't just hitting 40% - it's understanding which segment of users would be very disappointed and whether that segment is large enough to build a business around.

Mapster's segmentation shows you: "Solo freelancers: 15% PMF. Small agencies (3-10 people): 65% PMF." Now you know your ICP (Ideal Customer Profile) and can focus all your marketing/product efforts there instead of trying to be everything to everyone.

Retention and revenue are lagging indicators - they tell you what happened, not why. You can have good retention because of sunk cost ("I already paid for annual plan") or switching costs ("migrating data is too painful"), not because users love your product.

The PMF survey + qualitative feedback gives you the "why" behind the metrics. Example:

- High retention + Low PMF score = Users are stuck, not happy (churn risk when competitor shows up)

- Low retention + High PMF score = Great product, bad onboarding or pricing

- High retention + High PMF score = You're on the right track, double down

Surveys don't replace retention metrics - they give you context to understand what your retention numbers actually mean.

For early-stage (pre-100 users): Survey every active user once, after they've used the product enough to form an opinion (usually after 3-7 days of activity, not 3-7 days since signup).

For growth-stage (100+ users): Survey new cohorts monthly or quarterly. Mapster's widget triggers based on usage patterns, not time-based spam. A user who's logged in 10 times is more likely to give thoughtful feedback than someone who signed up yesterday.

The key is one quick question ("How would you feel if you could no longer use this?") + optional follow-up ("What's the primary benefit you get?"). Takes 30 seconds. Users who love your product want to tell you why - you're giving them a voice, not annoying them.

Don't panic and pivot immediately. First, look at the segmentation and qualitative feedback:

- If one segment scores 50%+ but others score 10%: Focus on the winning segment, ignore the rest

- If everyone scores low but feedback is "I'd use this if [specific feature]": Build that feature, re-survey

- If feedback is vague ("it's fine, I guess"): You might be solving a problem people don't actually have - consider pivot

Example: You score 25% overall, but when you filter for "users who logged in 5+ times in first week," that segment scores 55%. This tells you the product works, but your onboarding or targeting is off - not a pivot situation.

Use Mapster's segmentation to find your hidden winning segment before you throw everything away and start over.

Yes! PMF isn't binary—it's continuous. Reaching 40% in one segment doesn't mean the journey is over. Here's why ongoing measurement matters:

- Geographic expansion: Your product might have 60% PMF in California but 18% in Texas. You need data to know which markets to target next and how to adjust positioning for each region.

- New product lines: Adding a new feature or product? You're essentially hunting for PMF again with a new value proposition. Validate it before full build.

- Market evolution: Your competitors evolve, customer needs change, new alternatives emerge. PMF today ≠ PMF in 6 months. Continuous measurement keeps you ahead of erosion.

- Adjacent segments: You might have strong PMF with small agencies (3-10 employees) but weak PMF with enterprises. Expansion requires knowing which segments show early PMF signals.

Real-world example: Slack achieved initial PMF with tech startups, then had to re-measure and adjust positioning for enterprise, healthcare, education—each market required different features, messaging, and integrations. They didn't "set and forget" PMF; they continuously measured it across expansion.

Use Mapster to track PMF across geographies, segments, and product lines as you scale. This prevents you from expanding into markets where you don't have fit while doubling down on segments where you do.

Join 50+ founders measuring PMF and getting feedback

⚠️ 42% of Startups fail due to poor Product Market Fit (CB Insights, 2025)

Find Out If You Actually Have Product Market Fit

Know exactly which 40% of your users would be "very disappointed" without your product. That's the difference between guessing and knowing.

What happens after signup:

- 1.Copy widget script (1 line of code)

- 2.Choose a PMF survey template (or create custom)

- 3.Start collecting feedback & see your PMF score

🔥 12 founders signed up this week

Yes, We Use Our Own Product